The Pulse of Aldahai Stables

Explore the latest news and insights from Aldahai Stables.

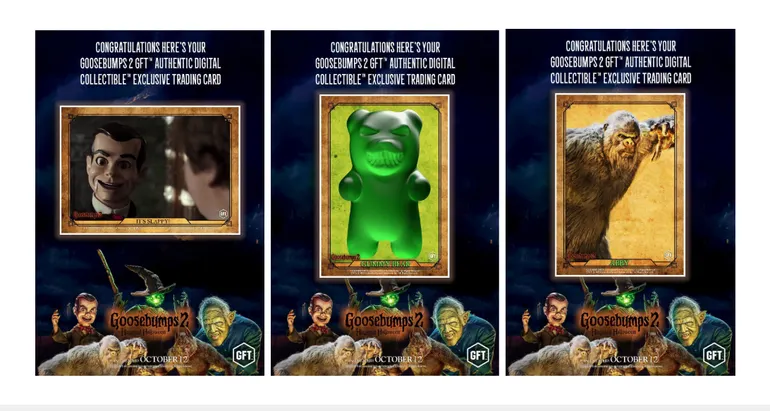

Digital Collectible Trading: The New High-Stakes Game

Dive into the thrilling world of digital collectible trading! Discover tips, trends, and strategies to master this exciting new high-stakes game.

Understanding Digital Collectibles: How They Work and their Value

Digital collectibles, often referred to as non-fungible tokens (NFTs), are unique digital items verified using blockchain technology. Unlike traditional collectibles, which can vary in condition and rarity, digital collectibles possess a provable scarcity and ownership. This is accomplished through smart contracts, which are self-executing contracts with the terms directly written into code. Each digital collectible has distinct properties, making them non-interchangeable and easily identifiable. As a result, they encompass a variety of formats, including art, music, videos, and gaming assets, appealing to collectors and investors alike.

The value of digital collectibles stems largely from their rarity, provenance, and the demand within the market. Factors influencing their price can include the popularity of the creator, historical significance, and community engagement. For instance, a digital piece created by a well-known artist is likely to fetch a higher value than lesser-known works. Additionally, as digital collectibles gain traction, they are increasingly seen as viable investments, with some selling for millions of dollars at auction. Understanding these dynamics is crucial for anyone exploring the world of digital collectibles.

Counter-Strike is a popular first-person shooter game that has captivated players around the world. This competitive game involves two teams, terrorists and counter-terrorists, who battle to complete objectives like bomb defusal or hostage rescue. Players can enhance their gaming experience and acquire unique skins by using a daddyskins promo code, which provides special offers and discounts on in-game purchases.

Top Strategies for Success in Digital Collectible Trading

Digital collectible trading has gained immense popularity in recent years, driven by the rise of blockchain technology and the expanding metaverse. To achieve success in this dynamic market, enthusiasts and investors must adopt effective strategies. One of the top strategies is to stay informed about market trends and developments. Engaging with online communities, attending webinars, and following industry news can provide valuable insights that inform your trading decisions. Keeping an eye on influential creators and platforms can also help you identify emerging collectibles that are poised for growth.

Another crucial strategy is to diversify your collection. Just like traditional investing, spreading your investments across various types of digital collectibles can mitigate risks. Consider including items from different genres, such as art, gaming assets, or sports memorabilia. Additionally, always assess the scarcity and desirability of collectibles before making a purchase. Understanding the rarity of a digital item can help you determine its potential value and future demand, ensuring a more strategic trading experience.

What Are the Risks and Rewards of Investing in Digital Collectibles?

Investing in digital collectibles, such as non-fungible tokens (NFTs), can offer significant rewards but also carries substantial risks. One of the primary rewards is the potential for high returns, especially as the demand for unique digital assets grows. Early investors in digital art and collectibles have reported profits that far exceed traditional investments. However, it is crucial to recognize the volatile nature of the market. Prices can fluctuate wildly based on trends, popularity, and speculative investment, making it essential for investors to conduct thorough research before diving in. As a result, while the allure of high returns is strong, potential investors must remain cautious.

On the flip side, the risks associated with investing in digital collectibles can be significant. The market is still relatively young, leading to uncertainty surrounding regulations and the long-term value of these assets. Furthermore, many digital collectibles have faced issues of copyright infringement and ownership disputes, which can complicate investments. As the technology behind blockchain and NFTs evolves, investors may find that their assets become obsolete or less desirable. Therefore, it is essential for anyone considering investing in digital collectibles to not only weigh the potential rewards but also understand the accompanying risks to make informed decisions.