The Pulse of Aldahai Stables

Explore the latest news and insights from Aldahai Stables.

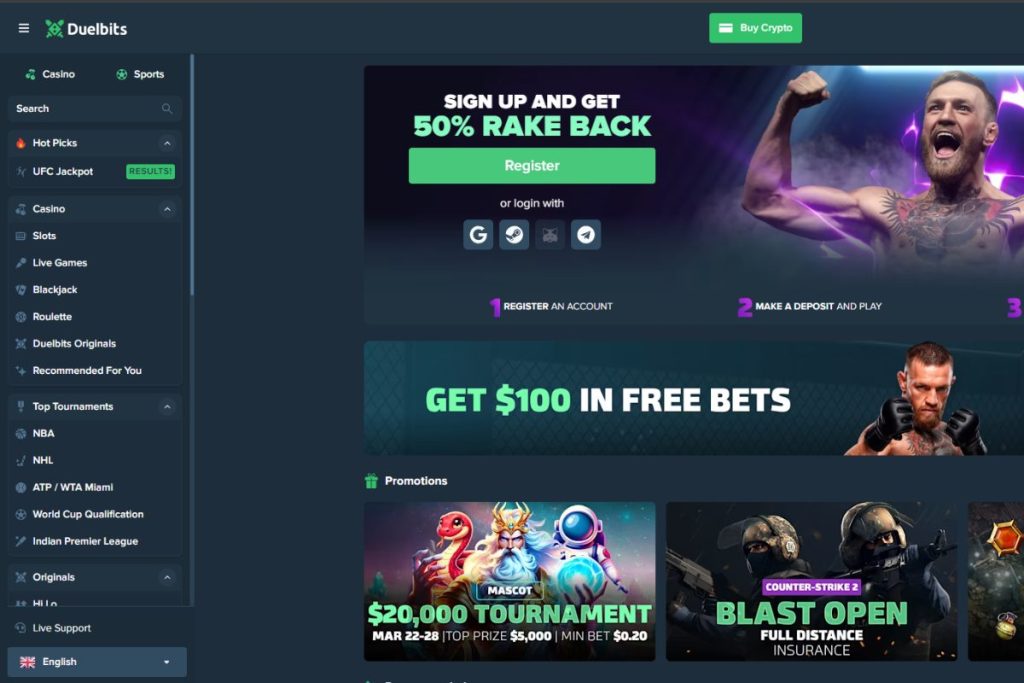

Duel Crypto Deposits: Double Down or Cash Out?

Discover the pros and cons of duel crypto deposits—will you double down on gains or cash out for safety? Uncover the best strategy now!

Understanding Duel Crypto Deposits: Risks and Rewards Explained

Understanding Duel Crypto Deposits involves recognizing both the potential benefits and the inherent risks. Unlike traditional single-asset deposits, duel crypto deposits allow investors to stake multiple cryptocurrencies simultaneously, often resulting in greater returns. However, this strategy comes with its own set of challenges. For instance, market volatility can impact the performance of each asset, leading to unpredictable outcomes. To mitigate these risks, it’s crucial to conduct thorough research and stay updated on price trends and market sentiment.

Moreover, Duel Crypto Deposits can complicate risk management strategies due to the nature of holding different assets. Investors may face issues such as liquidity concerns and the need for increased diligence in monitoring their investments. To take advantage of the rewards while minimizing potential downsides, consider employing strategies like diversification and setting clear investment goals. In summary, while duel crypto deposits can yield lucrative rewards, a comprehensive understanding of the associated risks is vital for successful investment.

Counter Strike is a popular team-based first-person shooter that has captivated gamers since its release. Players can engage in various game modes, including competitive matches and casual play, where strategy and teamwork are essential for victory. For those looking to enhance their gaming experience, they might be interested in checking out the Duel Referral Code to unlock exciting opportunities.

Is It Time to Double Down on Dual Crypto Deposits? A Deep Dive

The world of cryptocurrency continues to evolve rapidly, prompting investors to reconsider their strategies. One option that has garnered attention is the concept of dual crypto deposits, which allows users to deposit two different cryptocurrencies into a single account. This approach can potentially maximize yields while diversifying risk. By taking advantage of the benefits offered by both assets, investors can enhance their positions in the ever-fluctuating market. As we delve deeper into this topic, it’s important to assess whether doubling down on dual crypto deposits is a prudent strategy in today's financial landscape.

Before making a decision, investors should evaluate the inherent risks and rewards associated with dual deposits. For instance, while the potential for higher returns attracts many, the complexities involved can also complicate liquidity and withdrawal options. Furthermore, fluctuations in the relative values of the two cryptocurrencies can introduce additional volatility. Therefore, it's essential to conduct thorough research and consider factors such as market trends, security protocols, and diversification tactics. By weighing these elements, investors can determine if it's indeed time to double down on dual crypto deposits and align this strategy with their overall investment goals.

How to Decide: Should You Cash Out or Invest in Duel Crypto Deposits?

When faced with the decision of whether to cash out or invest in Duel Crypto Deposits, it's essential to evaluate your financial goals and risk tolerance. Start by assessing your current financial situation and consider how much of your capital you are willing to put at stake. If you’re in need of quick liquidity or have upcoming financial obligations, cashing out might be the preferable route. However, if you believe in the potential growth of crypto and are prepared to invest for the long term, moving towards Duel Crypto Deposits could offer greater rewards.

Another factor to weigh is the market conditions and the performance of your current investments. Analyzing trends and understanding the volatility of the crypto market can provide valuable insights. Consider conducting a detailed market analysis, including the following steps:

- Research current trends in the cryptocurrency market.

- Evaluate the potential risks and rewards of keeping your funds in Duel Crypto Deposits.

- Seek advice from financial advisors or investment communities.

Ultimately, the decision to cash out or invest in Duel Crypto Deposits should be made based on careful consideration of both your immediate financial needs and long-term investment objectives.