The Pulse of Aldahai Stables

Explore the latest news and insights from Aldahai Stables.

The Truth About Life Insurance: What No One Tells You

Uncover the secrets of life insurance that agents won't tell you. Protect your future with the truth!

5 Common Misconceptions About Life Insurance You Need to Know

Life insurance is often shrouded in misconceptions that can lead individuals to make uninformed decisions. One of the most prevalent misconceptions is that life insurance is only necessary for those with dependents. In reality, single individuals and young professionals may also benefit from having a policy to cover potential debts, funeral expenses, or to lock in lower premium rates while they are still healthy.

Another common belief is that life insurance is too expensive for the average person. Many people are surprised to learn that there are various affordable options available, including term life policies that can provide substantial coverage at a relatively low cost. According to Forbes, the average cost of life insurance may be much less than one would expect, often making it a feasible financial investment. Don't underestimate the importance of obtaining life insurance simply because of perceived costs.

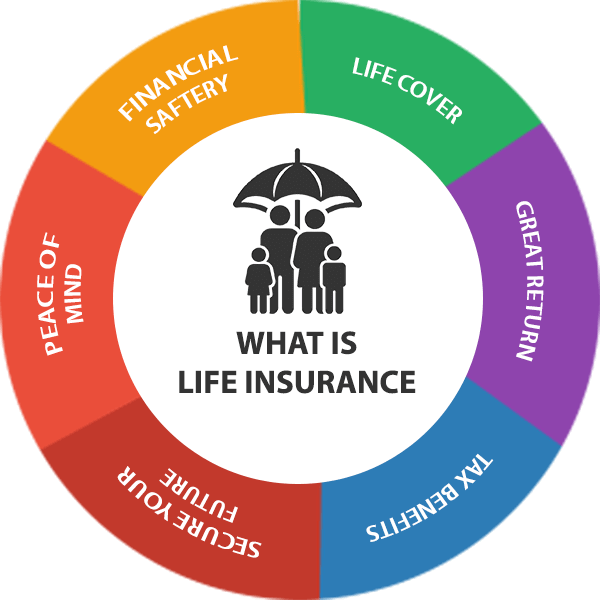

The Hidden Benefits of Life Insurance: What You're Missing

When considering life insurance, many people focus solely on the primary benefit—providing financial support to loved ones after one’s passing. However, there are numerous hidden benefits of life insurance that often go unnoticed. For instance, many policies offer a cash value component, which accumulates over time and can be borrowed against or withdrawn during your lifetime. This feature not only serves as a safety net during emergencies but also offers a potential source of retirement income or funds for significant life events like a child's education.

Moreover, life insurance can provide peace of mind and a sense of security that extends beyond mere financial concerns. Knowing that your family will be taken care of in your absence alleviates stress and anxiety. Additionally, many policies come with living benefits that allow policyholders to access funds if diagnosed with a terminal illness. This flexibility can be invaluable, offering you the opportunity to address health care needs, make cherished memories, or even fulfill bucket list items without the looming worry of financial burdens on your family.

Is Life Insurance Worth It? The Untold Truth Revealed

When considering life insurance, many people wonder if it is truly worth the investment. The truth is that life insurance can provide invaluable financial security for your loved ones in the event of your untimely passing. According to a report from the Insurance Information Institute, nearly 40% of American households would face financial hardship within six months of losing their primary wage earner. Without a solid plan in place, the burden may fall heavily on family members, making life insurance a vital safety net that protects your family’s future.

Furthermore, life insurance can also serve as a source of savings or investment. Many policies, such as whole life or universal life, come with a cash value component that grows over time, allowing you to borrow against it or even cash it out in the future. As highlighted by Forbes, there are many benefits to maintaining a policy beyond just the coverage aspect, making it a flexible financial tool. Ultimately, the decision to purchase life insurance hinges on your personal circumstances, but understanding the potential long-term advantages can help clarify if it’s truly worth it for you.